"ECORE - ESG Circle of Real Estate" - THE industry standard for ESG

Energy-efficient, green, sustainable: These concepts have long been firmly anchored in the real estate industry. But for about a year and a half there has been a new term that has already become an integral part of the real estate industry. E, S and G are the three letters that are now driving funds, portfolio holders, asset managers and, not least, property managers and facility managers.

The "E" for Environmental concerns, among other things, the factors of climate, resources or biodiversity. The "S" for Social includes such things as employees, user comfort, safety and health. The "G" for Governance (Corporate Governance) stands for topics such as risk and reputation management, supervisory structures, compliance and corruption.

The ECORE Initiative

About 18 months ago, the fund and asset management industry set out to develop the industry standard, together with Bell Management Consultants as a neutral control and coordination unit. Here was the birth of the ECORE ESG-Circle of Real Estate initiative.

Today, the ECORE initiative encompasses a broad field of around 100 participants and six associations.

In addition to the participants of ECORE ESG-Circle of Real Estate, the ESG Solution Partners, which also include ENGIE Deutschland, complement the initiative.

The ECORE scoring

But now for ECORE scoring: What is this standard and what is it for? With the ECORE-Scoring, a standard was created that combines all regulations, laws, regulations and the ESG criteria (including the required taxonomy criteria of the EU's Action Plan on Sustainable Finance and the goals of the Paris climate agreement) as well as already implemented certification systems (DGNB, BREEAM and LEED). The scoring is dynamic and is continuously adapted to the latest requirements of the EU.

ECORE offers the funds, investors, stockholders and project developers (as well as in the acquisition process) the opportunity to record the ESG status of their properties and to compare or benchmark them at individually selected levels across all asset classes. The score value is mapped using a point scale from zero to 100. Comparability in the peer group at an adequate cost is a central component of this ESG scoring. However, there is still a long way to go.

ECORE is applicable to all asset classes, Germany and Europe.

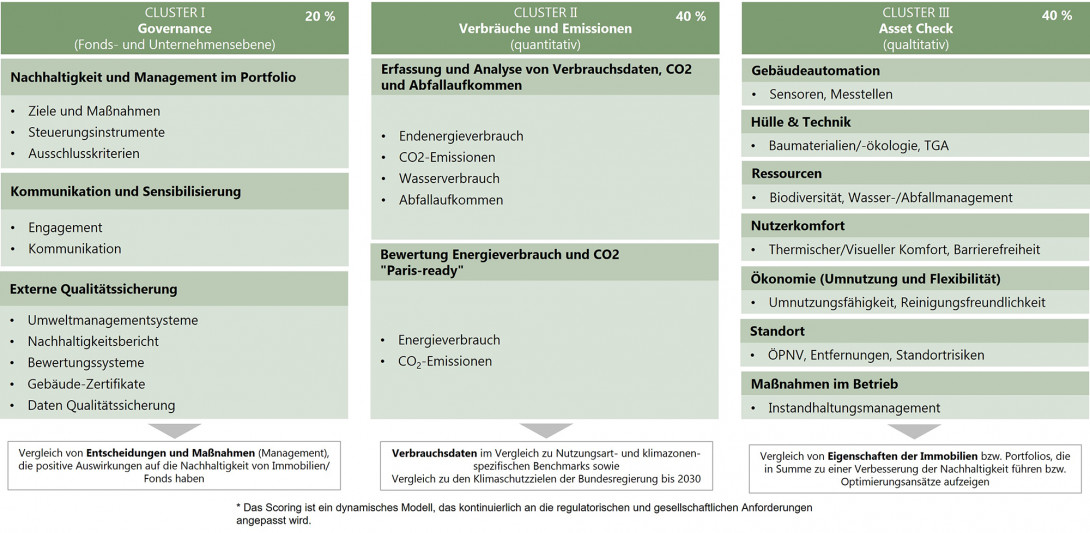

The scoring model consists of the three clusters Governance, Consumption and Issuance and Asset Check.

In "Cluster I - Governance", the focus is on sustainability and management in the portfolio, communication and external quality assurance (e.g. evidence, ratings). Among other things, this analyzes whether tenant exclusion criteria were applied or green leases were concluded.

In "Cluster II - Consumption and Emissions", the focus is on energy consumption, CO2 emissions, water consumption and waste generation, as well as the "Paris-Ready" assessment (comparison with the target data for 2030).

The "Cluster III - Asset Check" covers eight qualitative topics: Building automation, shell and technology, resources, user comfort, economy, location and operational measures.

Early involvement of solution partners

The group of ESG Solution Partners was added to the group of ECORE investors and project developers. These are made up of leading consulting and service companies in the real estate sector. Within the ECORE (ESG Circle of Real Estate) initiative, they see themselves as "enablers" who want to use their expertise and implementation skills to drive forward the achievement of sustainability goals together with real estate investors. For the ongoing dialog between ECORE investment houses and implementation partners, a regular meeting format with a variety of sustainability topics was created. The focus will be on the concrete exchange of ideas to increase the potential for optimization and on the joint work on strategies for achieving the climate goal by 2050.

Integration of other market players

The first banks have already joined ECORE. Since financiers will also have to take the ESG issue into account in the future as part of their risk pricing, it was important for us to also think within the ECORE standard at an early stage here in order to be able to build on what has already been developed. The appraiser side is also integrated. Recently, for example, the BIIS (Federal Association of Real Estate Investment Experts) has joined.

First Focus on inventory, now also development

The previous scoring is designed for existing properties, as this is where the major challenges lie with regard to CO2 neutrality. However, investor requirements are also currently changing for project developments. Against this backdrop, we will set up a "Development" specialist committee in addition to the existing "Regulatory Affairs" and "Verification" specialist committees. According to investors, many project developers do not yet have a comprehensive understanding of what new criteria and documentation requirements are relevant to property buyers.

Our Expert

ESG Analytics GmbH is part of Bell Management Consultants; one of the leading consulting companies in the real estate industry in Germany, Switzerland and Austria and initiator of the industry initiative ECORE, ESG-Circle of Real Estate.

BMC: bell-consultants.com

ECORE: ecore-scoring.com