A turbulent year: the energy market in 2022 in retrospect

2022 was a historic year for the energy market, with record high prices. Many market participants will remember it as a synonym for uncertainty. But what was going on and what is likely to be in store for us in 2023? Katrin Fuhrmann, Head of Origination at ENGIE, sums up the year and gives an outlook from a market perspective.

A year of extremes - unprecedented highs and lows in the energy market

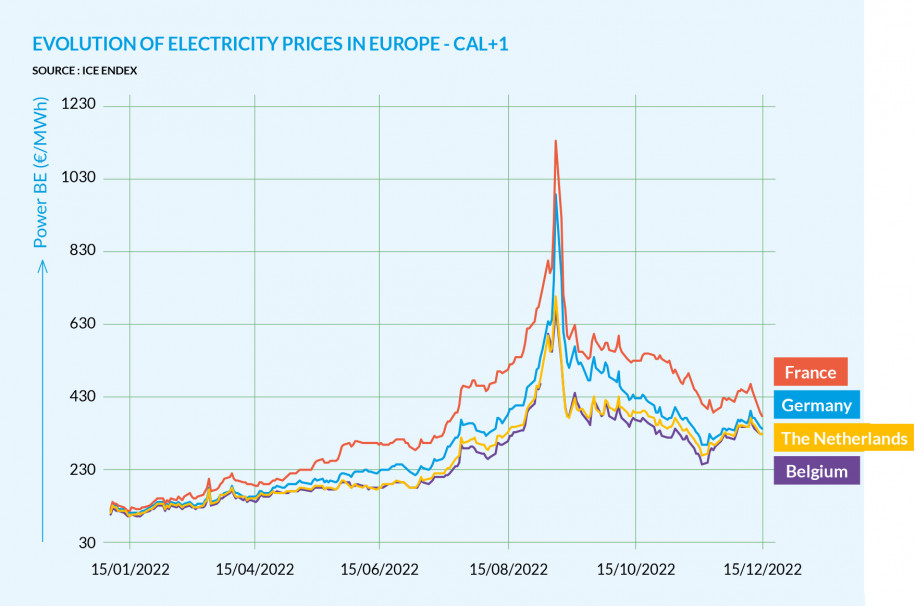

Many players in the energy market were almost speechless in 2022. As recently as 2021, no one would have expected such an overstretched market situation. Energy producers, traders and electricity consumers went from one extreme to the next. This development began as early as 2020 during the corona pandemic. It triggered the lowest energy prices we have ever seen. As a result, the following year, 2021, proved to be a difficult market year due to the global economic situation. After the outbreak of the war in Ukraine, the energy market was in a state of panic in 2022, and this uncertainty built up massively until the summer. This shows the development of electricity prices in 2022 at a glance:

In addition to the war in Ukraine, the unavailability of French nuclear power plants also contributed to the extreme increase in electricity prices. The background to this is that the plants, which are important for European supply, were not available over the summer. On top of that, commissioning was postponed several times. This caused prices on the energy market to shoot up on a speculative basis. At times, they were as high as 1,000 euros per megawatt hour in Germany. That is abruptly almost 15 times higher prices than had previously been the case. In addition, some prices fluctuated by up to 200 euros a day. Who is supposed to act efficiently and in a planned manner?

"Extreme volatility, shortages, peak prices - 2022 was a year that saw extremes that I hope we don't have to experience again. We have all gone through new highs and lows. The question now is where do we go from here and what can we expect from this year?"

Katrin Fuhrmann, Head of Origination at ENGIE

A question of risk - why we still relied on fixed prices

On the supplier side, the high energy prices have brought joy. Electricity producers were able to market their products much better after the long period of low prices and the previously less good years. This is an important signal, especially for the further expansion of renewable energies. On the other hand, industrial companies needed a lot of energy and in some cases no longer knew what to do because of the high prices.

2022, we have intensively weighed up the solutions we offer our customers. The focus was on fixing fixed prices for renewable energies - despite the uncertainties not only for the coming year, but for the next two to three years. Long-term power purchase agreements (PPAs) are the ideal trading instrument for this. Primarily fixed-price electricity supply contracts over longer periods enable companies to keep electricity costs and risks down despite panic on the market. Fixed prices also play an important role because many banks in this country require them for lending.

However: Due to the volatile and completely open market situation in the summer, almost no one dared to issue fixed prices - not so at ENGIE. Nevertheless, we fixed the prices for our customers for all but three particularly extreme weeks. This was a special situation on the energy market - and actually not an easy task. In order to react to the rapid price jumps and not take too much risk on the books, we often had to negotiate with suppliers and customers at the same time. Despite the circumstances, we were able to implement groundbreaking solutions for the energy market.

Equally Power and Security: PPA with Digital Realty

One of our most successful projects from 2022 in particular is the PPA with Digital Realty. We concluded a long-term electricity supply contract with the data center operator with a capacity of 116 megawatt hours at a fixed price. A new solar park of the investment company CEE Group in Brandenburg will supply the electricity in the future. What makes the agreement so interesting? For one thing, it was indeed special to conclude a PPA for 10 years with fixed prices in such an uncertain market. Secondly, we quickly managed to reconcile the different structures and wishes of our customers.

"As a major player in the renewable energy sector, we bring together suppliers and buyers of green power, even in a very volatile market environment. These transactions support the development of more renewables in Germany."

Katrin Fuhrmann, Head of Origination at ENGIE

Energy Market 2023: What lies ahead for companies

There will probably not be a price jump like last year. However, there are still some uncertainties. Although the energy market has calmed down again, no one can sit back and relax. On the contrary:

- Germany, for example, is no longer dependent on Russian energy imports. The new LNG terminals make the Federal Republic more dependent on the world market. This could bring new volatility effects.

- Supply chain issues and unavailable resources are also plaguing the upstream sector this year. Many renewable projects are therefore likely to be pushed back further, also due to a lack of construction permits.

- Furthermore, the market development must be kept in mind. If prices continue to fall over the course of the year, plant operators could demand surcharges to cover their costs. This would inevitably have an impact on the design of supply contracts and ultimately on the pace of renewables expansion.

- Market participants must also consider how to deal with new regulatory requirements. In this regard, the revenue skimming for renewable energies is worth mentioning. Since December 1, 2022, among other things, additional revenues from photovoltaic projects that are above the respective minimum remuneration will be skimmed off. The problem: These revenues often form the basis of existing electricity supply contracts. Solutions must be found here in the short term and on a case-by-case basis. The revenue skimming also means that we will have less green power available in 2023 than planned, as many operators will not market their existing plants via PPAs under these conditions. Without PPAs and new plants opting not to receive subsidies, the supply of green energy is barely sufficient to meet demand.

- Last but not least, it is not yet possible to predict how other regulatory decisions will affect the energy market. These include, for example, the Bidding Zone Review. It divides the German energy market into four trading zones. Also worth mentioning is Redispatch 2.0: In the future, grid operators will also be allowed to regulate the electricity production of renewable plants in order to ensure grid stability.

The energy market is and remains an exciting field

At ENGIE, we are proud of our performance in the past year. In 2023, we look forward to supporting our customers again with tailored solutions. Currently, we continue to work on our decarbonization products and will expand our position in PPAs. This includes long-term PPAs for new parks as well as flexible short-term PPAs for existing plants.

In the downstream area, we are working on products for 24/7 full supply, but are also looking for individual solutions for new players such as the steel industry, the chemical sector and other customers who want to take the step into the world of PPAs. In addition, some of our own plants will also go online this year. In addition, we still have numerous future projects on the agenda. Whether LNG, biomethane or hydrogen - now is the time when we start talking about offtake agreements for such products.

Our Expert